API Documentation¶

Curve Objects¶

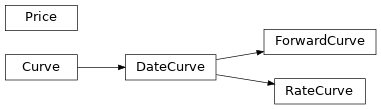

Basic Curves¶

Price object for assets |

|

Curve function object |

|

Curve function object with dates as domain (points) |

|

Forward price curve with yield extrapolation |

|

Interest rate curve and credit curve |

- class dcf.curves.curve.Price(value=0.0, origin=None)[source]¶

Bases:

objectPrice object for assets

- Parameters

value – price value

origin – price date

>>> from businessdate import BusinessDate >>> from dcf import Price >>> p=Price(100, BusinessDate(20201212)) >>> p.value 100.0 >>> float(p) 100.0 >>> p Price(100.000000; origin=BusinessDate(20201212))

- property value¶

asset price value

- property origin¶

asset price date

- class dcf.curves.curve.Curve(domain=(), data=(), interpolation=None)[source]¶

Bases:

objectCurve function object

- Parameters

domain (list(float)) – source values \(x_1 \dots x_n\)

data (list(float)) – target values \(y_1 \dots y_n\)

interpolation (function) –

(optional, default is defined on class level)

Interpolation function \(\gamma\) such that \(\gamma(x_i)=y_i\) for \(i=1 \dots n\).

If interpolation is a string, the interpolation function is taken from class member dictionary

dcf.curves.curve.Curve.INTERPOLATIONS.Interpolation functions \(\gamma\) can be constructed piecewise using via

dcf.interpolation.interpolation_scheme.

Curve function object

\[f:\mathbb{R} \rightarrow \mathbb{R}, x \mapsto f(x)=y\]build from finite point vectors \(x\) and \(y\) using piecewise various interpolation functions.>>> from dcf import Curve >>> c = Curve([0, 1, 2], [1, 2, 3])

get the grid of x values

>>> c.domain [0, 1, 2]

get the grid of y values

>>> c(c.domain) (1.0, 2.0, 3.0)

get a interpolated curve value

>>> c(1.5) 2.5

update existing values

>>> c[2] = 4 >>> c(c.domain) (1.0, 2.0, 4.0)

add new points

>>> c[3] = 5 >>> c(c.domain) (1.0, 2.0, 4.0, 5.0)

- INTERPOLATIONS = {}¶

mapping (dict) of availiable interpolations additional to

dcf.interpolation

- property kwargs¶

returns constructor arguments as ordered dictionary

- property domain¶

coordinates and date of given (not interpolated) x-values

- property table¶

table of interpolated rates (pretty printable) given by

dcf.rate_table().

- class dcf.curves.curve.DateCurve(domain=(), data=(), interpolation=None, origin=None, day_count=None)[source]¶

Bases:

CurveCurve function object with dates as domain (points)

curve function object with dates as domain (points)

- Parameters

domain – squences of date points

data – squence of curve values

interpolation – interpolation function (see

dcf.curves.curve.Curve)origin – inital origin of date points (used to calculate year fractions of poins in domain)

day_count – day count function to derive year fractions from time periods

>>> from dcf import DateCurve

domain given as date/time measured in year fraction (float)

>>> domain = 0.5, 1.0, 1.5, 2.0 >>> data = 1, 2, 3, 4

>>> c = DateCurve(domain, data) >>> c.domain (0.5, 1.0, 1.5, 2.0)

>>> c(0.75) 1.5

domain given as date/time measured in dates (date)

>>> from datetime import date

>>> domain = date(2022, 8, 12), date(2023, 2, 12), date(2023, 8, 12), date(2024, 2, 12) >>> data = 1, 2, 3, 4

>>> c = DateCurve(domain, data) >>> c.domain (datetime.date(2022, 8, 12), datetime.date(2023, 2, 12), datetime.date(2023, 8, 12), datetime.date(2024, 2, 12))

>>> c(date(2022, 11, 12)) 1.5

domain given as date/time measured in dates (BusinessDate)

>>> from businessdate import BusinessDate >>> t = BusinessDate(20220212)

>>> domain = tuple(t + p for p in ('6m', '12m', '18m', '24m')) >>> data = 1, 2, 3, 4

>>> c = DateCurve(domain, data) >>> c.domain (BusinessDate(20220812), BusinessDate(20230212), BusinessDate(20230812), BusinessDate(20240212))

>>> c(t + '9m') 1.5

- DAY_COUNT = {}¶

mapping (dict) of availiable day count functions additional to

dcf.daycount

- property domain¶

domain of curve \(t_1 \dots t_n\) as list of dates where curve values are given explicit

- property origin¶

date of origin (date zero) as curve reference date for time calucations

- day_count(start, end=None)[source]¶

day count function to calculate a year fraction of time period

- Parameters

start – first date of period

end – last date of period

- Returns

(float) year fraction

- to_curve()[source]¶

deprecated method to cast to

dcf.curves.curve.Curveobject

- integrate(start, stop)[source]¶

integrates curve and returns results as annualized rates

- Parameters

start – lower integration boundary

stop – upper integration boundary

- Returns

(float) integral value$

If \(\gamma\) is this the curve. integrate returns

\[\int_a^b \gamma(t)\ dt\]where \(a\) is start and \(b\) is stop.if available integrate uses scipy.integrate.quad

- derivative(start)[source]¶

calculates numericaly the first derivative

- Parameters

start – curve point to calcuate derivative at this point

- Returns

(float) first derivative

If \(\gamma\) is this the curve derivative returns

\[\frac{d}{dt}\gamma(t)\]where \(t\) is start but derived numericaly.if available derivative uses scipy.misc.derivative

- class dcf.curves.curve.ForwardCurve(domain=(), data=(), interpolation=None, origin=None, day_count=None, yield_curve=0.0)[source]¶

Bases:

DateCurveForward price curve with yield extrapolation

curve of future asset prices i.e. asset forward prices

- Parameters

domain – dates of given asset prices \(t_1 \dots t_n\)

data – actual asset prices \(p_{t_1} \dots p_{t_n}\)

interpolation – interpolation method for interpolating given asset prices

origin – origin of curve

day_count – day count method resp. function \(\tau\) to calculate year fractions

yield_curve – yield \(y\) to extrapolate by continous compounding

\[p_T = p_{t_n} \cdot \exp(y \cdot \tau(t_n, T))\]or yield curve function \(\gamma_c\) to extrapolate by\[p_T = p_{t_n} \cdot \gamma_c(T)/\gamma_c(t_n)\]or interest rate curve \(c\) extrapolate by\[p_T = p_{t_n} \cdot df_{c}^{-1}(t_n, T)\]

- yield_curve¶

yield curve for extrapolation using discount factors

- class dcf.curves.curve.RateCurve(domain=(), data=(), interpolation=None, origin=None, day_count=None, forward_tenor=None)[source]¶

Bases:

DateCurveInterest rate curve and credit curve

- Parameters

domain – either curve points \(t_1 \dots t_n\) or a curve object \(C\)

data – either curve values \(y_1 \dots y_n\) or a curve object \(C\)

interpolation – (optional) interpolation scheme

origin – (optional) curve points origin \(t_0\)

day_count – (optional) day count convention function \(\tau(s, t)\)

forward_tenor – (optional) forward rate tenor period \(\tau^*\)

If data is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given by domain.If domain is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given domain property of \(C\).Further arguments interpolation, origin, day_count, forward_tenor will replace the ones given by \(C\) if not given explictly.

- property forward_tenor¶

tenor (time period) associated to the rates of the curve

- property spread¶

spread curve to add spreads to curve

- dcf.curves.curve.rate_table(curve, x_grid=None, y_grid=None)[source]¶

table of calculated rates

- Parameters

curve – function \(f\)

x_grid – vertical date axis \(x_0, \dots, x_m\)

y_grid – horizontal period axis \(y_1, \dots, y_n\) (implicitly added a non-period \(y_0=0\))

- Returns

list(list(float)) matrix \(T=(t_{i,j})\) with \(t_{i,j}=f(x_i+y_j) \text{ if } x_i+y_j < x_{i+1}\).

>>> from tabulate import tabulate >>> from dcf import Curve, rate_table >>> curve = Curve([1, 4], [0, 1]) >>> table = rate_table(curve, x_grid=(0, 1, 2, 3, 4, 5), y_grid=(.0, .25, .5, .75)) >>> print(tabulate(table, headers='firstrow', floatfmt='.4f')) 0.0 0.25 0.5 0.75 -- ------ ------ ------ ------ 0 0.0000 0.0000 0.0000 0.0000 1 0.0000 0.0833 0.1667 0.2500 2 0.3333 0.4167 0.5000 0.5833 3 0.6667 0.7500 0.8333 0.9167 4 1.0000 1.0000 1.0000 1.0000 5 1.0000 1.0000 1.0000 1.0000

>>> from businessdate import BusinessDate, BusinessPeriod >>> from dcf import ZeroRateCurve

>>> term = '1m', '3m', '6m', '1y', '2y', '5y', >>> rates = -0.008, -0.0057, -0.0053, -0.0036, -0.0010, 0.0014, >>> today = BusinessDate(20211201) >>> tenor = BusinessPeriod('1m') >>> dates = [today + t for t in term] >>> f = ZeroRateCurve(dates, rates, origin=today, forward_tenor=tenor)

>>> print(tabulate(f.table, headers='firstrow', floatfmt=".4f", tablefmt='latex')) \begin{tabular}{lrrrrrrr} \hline & 0D & 1M & 2M & 3M & 6M & 1Y & 2Y \\ \hline 20211201 & -0.0080 & & & & & & \\ 20220101 & -0.0080 & -0.0068 & & & & & \\ 20220301 & -0.0057 & -0.0056 & -0.0054 & & & & \\ 20220601 & -0.0053 & -0.0050 & -0.0047 & -0.0044 & & & \\ 20221201 & -0.0036 & -0.0034 & -0.0032 & -0.0030 & -0.0023 & & \\ 20231201 & -0.0010 & -0.0009 & -0.0009 & -0.0008 & -0.0006 & -0.0002 & 0.0006 \\ 20261201 & 0.0014 & 0.0014 & 0.0014 & 0.0014 & 0.0014 & 0.0014 & 0.0014 \\ \hline \end{tabular}

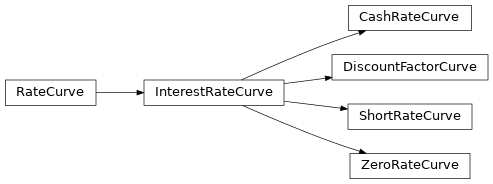

Interest Rate Curves¶

Base class of interest rate curve classes |

|

Interest rate curve storing and interpolating data as zero rates |

|

Interest rate curve storing and interpolating data as discount factor |

|

Interest rate curve storing and interpolating data as cash rate |

|

Interest rate curve storing and interpolating data as short rate |

- class dcf.curves.interestratecurve.InterestRateCurve(domain=(), data=(), interpolation=None, origin=None, day_count=None, forward_tenor=None)[source]¶

Bases:

RateCurveBase class of interest rate curve classes

All interest rate curves share the same four fundamental methodological methods

dcf.curves.interestratecurve.InterestRateCurve.get_discount_factor()dcf.curves.interestratecurve.InterestRateCurve.get_zero_rate()dcf.curves.interestratecurve.InterestRateCurve.get_cash_rate()dcf.curves.interestratecurve.InterestRateCurve.get_short_rate()dcf.curves.interestratecurve.InterestRateCurve.get_swap_annuity()

All subclasses differ only in data types for storage and interpolation.

- Parameters

domain – either curve points \(t_1 \dots t_n\) or a curve object \(C\)

data – either curve values \(y_1 \dots y_n\) or a curve object \(C\)

interpolation – (optional) interpolation scheme

origin – (optional) curve points origin \(t_0\)

day_count – (optional) day count convention function \(\tau(s, t)\)

forward_tenor – (optional) forward rate tenor period \(\tau^*\)

If data is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given by domain.If domain is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given domain property of \(C\).Further arguments interpolation, origin, day_count, forward_tenor will replace the ones given by \(C\) if not given explictly.

- get_discount_factor(start, stop=None)[source]¶

discounting factor for future cashflows

- Parameters

start – date \(t_0\) to discount to

stop – date \(t_1\) for discounting from (optional, if not given \(t_0\) will be origin and \(t_1\) by start)

- Returns

discounting factor \(df(t_0, t_1)\)

Assuming a constant bank account interest rate \(r\) over time and interest rate compounding a bank account of \(B_0=1\) at time \(t_0\) will be some value \(B_1\) at time \(t_1\).

For continuous compounding \(B_1=B_0 * \exp(r\cdot (t_1-t_0))\), for more concepts of compounding see

dcf.compounding.Since \(B_1\) is equivalent to the value of \(B_0\) at time \(t_1\), \(B_0/B_1\) can be understood to as the price at time \(t_0\) of a bank account of \(1\) at \(t_1\).

In general, discount factor \(df(t_0, t_1)= B_0/B_1\) are used to give the price or present value \(v_0(CF)\) at time \(t_0\) of any cashflow \(CF\) at time \(t_1\) by

\[v_0(CF) = df(t_0, t_1) \cdot CF.\]This concept relates to the zero bond yields

dcf.curves.interestratecurve.InterestRateCurve.get_zero_rate().

- get_zero_rate(start, stop=None)[source]¶

curve of zero rates, i.e. yields of zero cupon bonds

- Parameters

start – zero bond start date \(t_0\)

stop – zero bond end date \(t_1\)

- Returns

zero bond rate \(z(t_0, t_1)\)

Assume a current price is \(P(t_0, t_1)\) at time \(t_0\) of a zero cupon bond \(P\) paying \(1\) at maturity \(t_1\) without any interest or cupons.

Such zero bond prices are used to give the price or present value \(v_0(CF)\) at time \(t_0\) of any cashflow \(CF\) at time \(t_1\) by

\[v_0(CF) = P(t_0, t_1) \cdot CF = \exp(-z(t_1-t_0) \cdot \tau(t_1-t_0)) \cdot CF\]where \(\tau\) is the day count method to calculate the year fraction of the interest accrual period form \(t_i\) to \(t_{i+1}\) given by

dcf.curves.curve.DateCurve.day_count().Note, this concept relates to the discount factor \(df(t_0, t_1)\) of

dcf.curves.interestratecurve.InterestRateCurve.get_discount_factor()by\[df(t_0, t_1) = \exp(-z(t_1-t_0) \cdot \tau(t_1 - t_0)).\]Note, this concept relates to short rates \(df(t_0, t_1)\) of

dcf.curves.interestratecurve.InterestRateCurve.get_short_rate()by\[z(t_0,t_1)(t_1-t_0) = \int_{t_0}^{t_1} r(t) dt.\]

- get_short_rate(start)[source]¶

constant interpolated short rate derived from zero rate

- Parameters

start (date) – point in time \(t\) of short rate

- Returns

short rate \(r_t\) at given point in time

Calculation assumes a zero rate derived from a interpolated short rate, i.e.

Let \(r_t=r(t)\) be the short rate on given time grid \(t_0, t_1, \dots, t_n\) and let \(z(s, t)\) be the zero rate from \(s\) to \(t\) with \(s, t \in \{t_0, t_1, \dots, t_n\}\).

Hence,

\[\int_s^t r(\tau) d\tau = \int_s^t c_s d\tau = \Big[c_s \tau \Big]_s^t = c_s(s-t)\]and so

\[c_s = z(s, t).\]See also

dcf.curves.interestratecurve.InterestRateCurve.get_zero_rate().

- get_cash_rate(start, stop=None, step=None)[source]¶

interbank cash lending rate

- Parameters

start – start date of cash lending

stop – end date of cash lending (optional; default start + step)

step – period length of cash lending (optional; by default step is taken from

dcf.curves.curve.RateCurve.forward_tenor)

- Returns

simple compounded interest (forward) rate \(f\)

Let start be \(t_0\). If step and stop are given as \(\tau\) and \(t_1\) then start + step = stop must meet such that \(t_0 + \tau = t_1\) in

\[f(t_0, t_1)=\frac{1}{\tau}\big(\frac{1}{df(t_0, t_1)}-1\big).\]Due to the benchmark reform most classical cash rates as the LIBOR rates have been replaced by overnight rates, e.g. SOFR, SONIA etc. Derived from future prediictions of overnight rates (aka short term rates) long term rates with tenors of \(1m\), \(3m\), \(6m\) and \(12m\) are published, too.

For classical term rates see LIBOR and EURIBOR, for overnight rates see SOFR, ESTR, SONIA and SARON as well as TONAR.

- get_swap_annuity(date_list)[source]¶

swap annuity as the accrual period weighted sum of discount factors

- Parameters

date_list – list of period \(t_0, \dots t_n\)

- Returns

swap annuity \(A(t_0, \dots, t_n)\)

As

\[A(t_0, \dots, t_n) = \sum_{i=1}^n df(0, t_i) \tau (t_i, t_{i+1})\]with

\(0\) given by

dcf.curves.curve.DateCurve.origin\(df\) discount factor given by

dcf.curves.interestratecurve.InterestRateCurve.get_discount_factor()\(\tau \) day count method to calculate the year fraction of the interest accrual period form \(t_i\) to \(t_{i+1}\) given by

dcf.curves.curve.DateCurve.day_count()

- class dcf.curves.interestratecurve.ZeroRateCurve(domain=(), data=(), interpolation=None, origin=None, day_count=None, forward_tenor=None)[source]¶

Bases:

InterestRateCurveInterest rate curve storing and interpolating data as zero rates

\[z(t)=y_t\]- Parameters

domain – either curve points \(t_1 \dots t_n\) or a curve object \(C\)

data – either curve values \(y_1 \dots y_n\) or a curve object \(C\)

interpolation – (optional) interpolation scheme

origin – (optional) curve points origin \(t_0\)

day_count – (optional) day count convention function \(\tau(s, t)\)

forward_tenor – (optional) forward rate tenor period \(\tau^*\)

If data is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given by domain.If domain is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given domain property of \(C\).Further arguments interpolation, origin, day_count, forward_tenor will replace the ones given by \(C\) if not given explictly.

- class dcf.curves.interestratecurve.DiscountFactorCurve(domain=(), data=(), interpolation=None, origin=None, day_count=None, forward_tenor=None)[source]¶

Bases:

InterestRateCurveInterest rate curve storing and interpolating data as discount factor

\[df(t)=y_t\]- Parameters

domain – either curve points \(t_1 \dots t_n\) or a curve object \(C\)

data – either curve values \(y_1 \dots y_n\) or a curve object \(C\)

interpolation – (optional) interpolation scheme

origin – (optional) curve points origin \(t_0\)

day_count – (optional) day count convention function \(\tau(s, t)\)

forward_tenor – (optional) forward rate tenor period \(\tau^*\)

If data is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given by domain.If domain is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given domain property of \(C\).Further arguments interpolation, origin, day_count, forward_tenor will replace the ones given by \(C\) if not given explictly.

- class dcf.curves.interestratecurve.CashRateCurve(domain=(), data=(), interpolation=None, origin=None, day_count=None, forward_tenor=None)[source]¶

Bases:

InterestRateCurveInterest rate curve storing and interpolating data as cash rate

\[f(t, t+\tau^*)=y_t\]- Parameters

domain – either curve points \(t_1 \dots t_n\) or a curve object \(C\)

data – either curve values \(y_1 \dots y_n\) or a curve object \(C\)

interpolation – (optional) interpolation scheme

origin – (optional) curve points origin \(t_0\)

day_count – (optional) day count convention function \(\tau(s, t)\)

forward_tenor – (optional) forward rate tenor period \(\tau^*\)

If data is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given by domain.If domain is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given domain property of \(C\).Further arguments interpolation, origin, day_count, forward_tenor will replace the ones given by \(C\) if not given explictly.

- class dcf.curves.interestratecurve.ShortRateCurve(domain=(), data=(), interpolation=None, origin=None, day_count=None, forward_tenor=None)[source]¶

Bases:

InterestRateCurveInterest rate curve storing and interpolating data as short rate

\[r(t)=y_t\]- Parameters

domain – either curve points \(t_1 \dots t_n\) or a curve object \(C\)

data – either curve values \(y_1 \dots y_n\) or a curve object \(C\)

interpolation – (optional) interpolation scheme

origin – (optional) curve points origin \(t_0\)

day_count – (optional) day count convention function \(\tau(s, t)\)

forward_tenor – (optional) forward rate tenor period \(\tau^*\)

If data is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given by domain.If domain is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given domain property of \(C\).Further arguments interpolation, origin, day_count, forward_tenor will replace the ones given by \(C\) if not given explictly.

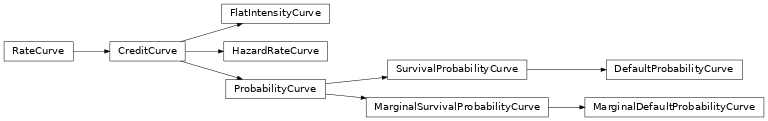

Credit Curves¶

Base class of credit curve classes |

|

Interest rate curve storing and interpolating data as discount factor |

|

Credit curve storing and interpolating data as intensities |

|

Credit curve storing and interpolating data as hazard rate |

|

Credit curve storing and interpolating data as intensities |

|

Credit curve storing and interpolating data as marginal default probability |

- class dcf.curves.creditcurve.CreditCurve(domain=(), data=(), interpolation=None, origin=None, day_count=None, forward_tenor=None)[source]¶

Bases:

RateCurveBase class of credit curve classes

All credit curves share the same three fundamental methodological methods

All subclasses differ only in data types for storage and interpolation.

- Parameters

domain – either curve points \(t_1 \dots t_n\) or a curve object \(C\)

data – either curve values \(y_1 \dots y_n\) or a curve object \(C\)

interpolation – (optional) interpolation scheme

origin – (optional) curve points origin \(t_0\)

day_count – (optional) day count convention function \(\tau(s, t)\)

forward_tenor – (optional) forward rate tenor period \(\tau^*\)

If data is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given by domain.If domain is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given domain property of \(C\).Further arguments interpolation, origin, day_count, forward_tenor will replace the ones given by \(C\) if not given explictly.

- get_survival_prob(start, stop=None)[source]¶

survival probability of credit curve

- Parameters

start – start point in time \(t_0\) of period

stop – end point \(t_1\) of period (optional, if not given \(t_0\) will be origin and \(t_1\) taken from start)

- Returns

survival probability \(sv(t_0, t_1)\) for period \(t_0\) to \(t_1\)

Assume an uncertain event \(\chi\), e.g. occurrence of a credit default event such as a loan borrower failing to fulfill the obligation to pay back interest or redemption.

Let \(\iota_\chi\) be the point in time when the event \(\chi\) happens.

Then the survival probability \(sv(t_0, t_1)\) is the probability of not occurring \(\chi\) until \(t_1\) if \(\chi\) didn’t happen until \(t_0\), i.e.

\[sv(t_0, t_1) = 1 - P(t_0 < \iota_\chi \leq t_1)\]

- get_flat_intensity(start, stop=None)[source]¶

intensity value of credit curve

- Parameters

start – start point in time \(t_0\) of intensity

stop – end point \(t_1\) of intensity (optional, if not given \(t_0\) will be origin and \(t_1\) taken from start)

- Returns

intensity \(\lambda(t_0, t_1)\)

The intensity \(\lambda(t_0, t_1)\) relates to survival probabilities by

\[sv(t_0, t_1) = exp(-\lambda(t_0, t_1) \cdot \tau(t_0, t_1)).\]

- class dcf.curves.creditcurve.ProbabilityCurve(domain=(), data=(), interpolation=None, origin=None, day_count=None, forward_tenor=None)[source]¶

Bases:

CreditCurvebase class of probability based credit curve classes

- Parameters

domain – either curve points \(t_1 \dots t_n\) or a curve object \(C\)

data – either curve values \(y_1 \dots y_n\) or a curve object \(C\)

interpolation – (optional) interpolation scheme

origin – (optional) curve points origin \(t_0\)

day_count – (optional) day count convention function \(\tau(s, t)\)

forward_tenor – (optional) forward rate tenor period \(\tau^*\)

If data is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given by domain.If domain is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given domain property of \(C\).Further arguments interpolation, origin, day_count, forward_tenor will replace the ones given by \(C\) if not given explictly.

- class dcf.curves.creditcurve.SurvivalProbabilityCurve(domain=(), data=(), interpolation=None, origin=None, day_count=None, forward_tenor=None)[source]¶

Bases:

ProbabilityCurveInterest rate curve storing and interpolating data as discount factor

\[sv(0, t)=y_t\]- Parameters

domain – either curve points \(t_1 \dots t_n\) or a curve object \(C\)

data – either curve values \(y_1 \dots y_n\) or a curve object \(C\)

interpolation – (optional) interpolation scheme

origin – (optional) curve points origin \(t_0\)

day_count – (optional) day count convention function \(\tau(s, t)\)

forward_tenor – (optional) forward rate tenor period \(\tau^*\)

If data is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given by domain.If domain is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given domain property of \(C\).Further arguments interpolation, origin, day_count, forward_tenor will replace the ones given by \(C\) if not given explictly.

- class dcf.curves.creditcurve.DefaultProbabilityCurve(domain=(), data=(), interpolation=None, origin=None, day_count=None, forward_tenor=None)[source]¶

Bases:

SurvivalProbabilityCurveCredit curve storing and interpolating data as default probability

\[pd(0, t)=1-sv(0, t)=y_t\]- Parameters

domain – either curve points \(t_1 \dots t_n\) or a curve object \(C\)

data – either curve values \(y_1 \dots y_n\) or a curve object \(C\)

interpolation – (optional) interpolation scheme

origin – (optional) curve points origin \(t_0\)

day_count – (optional) day count convention function \(\tau(s, t)\)

forward_tenor – (optional) forward rate tenor period \(\tau^*\)

If data is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given by domain.If domain is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given domain property of \(C\).Further arguments interpolation, origin, day_count, forward_tenor will replace the ones given by \(C\) if not given explictly.

- class dcf.curves.creditcurve.FlatIntensityCurve(domain=(), data=(), interpolation=None, origin=None, day_count=None, forward_tenor=None)[source]¶

Bases:

CreditCurveCredit curve storing and interpolating data as intensities

\[\lambda(t)=y_t\]- Parameters

domain – either curve points \(t_1 \dots t_n\) or a curve object \(C\)

data – either curve values \(y_1 \dots y_n\) or a curve object \(C\)

interpolation – (optional) interpolation scheme

origin – (optional) curve points origin \(t_0\)

day_count – (optional) day count convention function \(\tau(s, t)\)

forward_tenor – (optional) forward rate tenor period \(\tau^*\)

If data is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given by domain.If domain is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given domain property of \(C\).Further arguments interpolation, origin, day_count, forward_tenor will replace the ones given by \(C\) if not given explictly.

- class dcf.curves.creditcurve.HazardRateCurve(domain=(), data=(), interpolation=None, origin=None, day_count=None, forward_tenor=None)[source]¶

Bases:

CreditCurveCredit curve storing and interpolating data as hazard rate

\[hz(t)=y_t\]- Parameters

domain – either curve points \(t_1 \dots t_n\) or a curve object \(C\)

data – either curve values \(y_1 \dots y_n\) or a curve object \(C\)

interpolation – (optional) interpolation scheme

origin – (optional) curve points origin \(t_0\)

day_count – (optional) day count convention function \(\tau(s, t)\)

forward_tenor – (optional) forward rate tenor period \(\tau^*\)

If data is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given by domain.If domain is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given domain property of \(C\).Further arguments interpolation, origin, day_count, forward_tenor will replace the ones given by \(C\) if not given explictly.

- class dcf.curves.creditcurve.MarginalSurvivalProbabilityCurve(domain=(), data=(), interpolation=None, origin=None, day_count=None, forward_tenor=None)[source]¶

Bases:

ProbabilityCurveCredit curve storing and interpolating data as intensities

\[sv(t, t+\tau^*)=y_t\]- Parameters

domain – either curve points \(t_1 \dots t_n\) or a curve object \(C\)

data – either curve values \(y_1 \dots y_n\) or a curve object \(C\)

interpolation – (optional) interpolation scheme

origin – (optional) curve points origin \(t_0\)

day_count – (optional) day count convention function \(\tau(s, t)\)

forward_tenor – (optional) forward rate tenor period \(\tau^*\)

If data is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given by domain.If domain is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given domain property of \(C\).Further arguments interpolation, origin, day_count, forward_tenor will replace the ones given by \(C\) if not given explictly.

- class dcf.curves.creditcurve.MarginalDefaultProbabilityCurve(domain=(), data=(), interpolation=None, origin=None, day_count=None, forward_tenor=None)[source]¶

Bases:

MarginalSurvivalProbabilityCurveCredit curve storing and interpolating data as marginal default probability

\[pd(t, t+\tau^*)=1-sv(t, t+\tau^*)=y_t\]- Parameters

domain – either curve points \(t_1 \dots t_n\) or a curve object \(C\)

data – either curve values \(y_1 \dots y_n\) or a curve object \(C\)

interpolation – (optional) interpolation scheme

origin – (optional) curve points origin \(t_0\)

day_count – (optional) day count convention function \(\tau(s, t)\)

forward_tenor – (optional) forward rate tenor period \(\tau^*\)

If data is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given by domain.If domain is a

dcf.curves.curve.RateCurveinstance \(C\), it is casted to this new class type with domain grid given domain property of \(C\).Further arguments interpolation, origin, day_count, forward_tenor will replace the ones given by \(C\) if not given explictly.

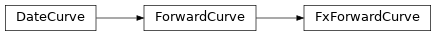

Fx Curve¶

fx rate curve for currency pair |

- class dcf.curves.fx.FxRate(value=0.0, origin=None)[source]¶

Bases:

Priceprice object for foreign currency exchange rates

- Parameters

value – price value

origin – price date

>>> from businessdate import BusinessDate >>> from dcf import Price >>> p=Price(100, BusinessDate(20201212)) >>> p.value 100.0 >>> float(p) 100.0 >>> p Price(100.000000; origin=BusinessDate(20201212))

- property origin¶

asset price date

- property value¶

asset price value

- class dcf.curves.fx.FxForwardCurve(domain=(), data=(), interpolation=None, origin=None, day_count=None, domestic_curve=None, foreign_curve=None)[source]¶

Bases:

ForwardCurvefx rate curve for currency pair

Cashflow Objects¶

Build Functions¶

- dcf.plans.same(num, amount=1.0)[source]¶

all same payment plan

- Parameters

num – number of payments \(n\)

amount – amount of each payment \(N\)

- Returns

list(float) payment plan \(X_i\) for \(i=1 \dots n\)

Payment plan with

\[X_i = N \text{ for all } i=1 \dots n\]

- dcf.plans.bullet(num, amount=1.0)[source]¶

bullet payment plan

- Parameters

num – number of payments \(n\)

amount – amount of last bullet payment \(N\)

- Returns

list(float) payment plan \(X_i\) for \(i=1 \dots n\)

Payment plan with

\[X_i = N \text{ for } i=n \text{ else } 0\]

- dcf.plans.amortize(num, amount=1.0)[source]¶

linear amortize payment plan

- Parameters

num – number of payments \(n\)

amount – amount of total sum of payment \(N\)

- Returns

list(float) payment plan \(X_i\) for \(i=1 \dots n\)

Payment plan with

\[X_i = N/n \text{ for } i=1 \dots n\]

- dcf.plans.annuity(num, amount=1.0, fixed_rate=0.01)[source]¶

fixed rate annuity payment plan

- Parameters

num – number of payments \(n\)

amount – amount of total sum of payment \(N\)

fixed_rate – amortization rate \(r\)

- Returns

list(float) payment plan \(X_i\) for \(i=1 \dots n\)

Payment plan

\[X_i = \frac{r}{(1 + r)^{n-i}} \cdot N \text{ for } i=1 \dots n\]

- dcf.plans.consumer(num, amount=1.0, fixed_rate=0.01)[source]¶

consumer loan annuity payment plan

- Parameters

num – number of payments \(n\)

amount – amount of payment total \(N\)

fixed_rate – amortization rate \(r\)

- Returns

list(float) payment plan \(X_i\) for \(i=1 \dots n\)

Actutal payment plan total \(T = N (1 + n \cdot r)\) such that

\[X_i = T / n\]

- dcf.plans.outstanding(plan, amount=1.0, sign=False)[source]¶

sums up plans to remaining oustanding anmount

- Parameters

plan – payment plan \(X_i\)

amount – inital amount \(N\)

sign – \(\sigma\) sign of plan payments (optional, default: -1)

- Returns

list(float) outstanding plan

Adds or substracts payment plan payments \(X_i\) from inital amount \(N\) such that

\[O_i = N + \sigma \cdot \sum_{k=1}^{i-1} X_i\]

Cashflow Objects¶

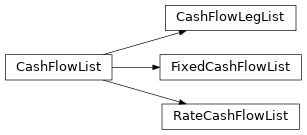

- class dcf.cashflows.cashflow.CashFlowList(payment_date_list=(), amount_list=(), origin=None)[source]¶

Bases:

objectbasic cashflow list object

- Parameters

domain – list of cashflow dates

data – list of cashflow amounts

origin – origin of object, i.e. start date of the cashflow list as a product

Basicly

dcf.cashflows.cashflow.CashFlowListworks like a read-only dictionary with payment dates as keys.And the

dcf.cashflows.cashflow.CashFlowList.domainproperty holds the payment date list.>>> from dcf import CashFlowList >>> cf_list = CashFlowList([0, 1], [-100., 100.]) >>> cf_list.domain (0, 1)

In order to get cashflows

>>> cf_list[0] -100.0 >>> cf_list[cf_list.domain] (-100.0, 100.0)

This works even for dates without cashflow

>>> cf_list[-1, 0 , 1, 2] (0.0, -100.0, 100.0, 0.0)

- property table¶

cashflow details as list of tuples

- property domain¶

payment date list

- property origin¶

cashflow list start date

- property kwargs¶

returns constructor arguments as ordered dictionary (under construction)

- class dcf.cashflows.cashflow.CashFlowLegList(legs)[source]¶

Bases:

CashFlowListMultiCashFlowList

container class for CashFlowList

- Parameters

legs – list of

dcf.cashflows.cashflow.CashFlowList

- property legs¶

- class dcf.cashflows.cashflow.FixedCashFlowList(payment_date_list, amount_list=1.0, origin=None)[source]¶

Bases:

CashFlowListbasic cashflow list object

- Parameters

payment_date_list – list of cashflow payment dates

amount_list – list of cashflow amounts

origin – origin of object, i.e. start date of the cashflow list as a product

- class dcf.cashflows.cashflow.RateCashFlowList(payment_date_list, amount_list=1.0, origin=None, day_count=None, fixing_offset=None, pay_offset=None, fixed_rate=0.0, forward_curve=None)[source]¶

Bases:

CashFlowListlist of cashflows by interest rate payments

list of interest rate cashflows

- Parameters

payment_date_list – pay dates, assuming that pay dates agree with end dates of interest accrued period

amount_list – notional amounts

origin – start date of first interest accrued period

day_count – day count convention

fixing_offset – time difference between interest rate fixing date and interest period payment date

pay_offset – time difference between interest period end date and interest payment date

fixed_rate – agreed fixed rate

forward_curve – interest rate curve for forward estimation

Let \(t_0\) be the list origin and \(t_i\) \(i=1, \dots n\) the payment_date_list with \(N_i\) \(i=1, \dots n\) the notional amount_list.

Moreover, let \(\tau\) be the day_count function, \(c\) the fixed_rate and \(f\) the forward_curve.

Then, the rate cashflow \(cf_i\) payed at time \(t_i\) will be with \(s_i = t_{i-1} - \delta\), \(e_i = t_i -\delta\) as well as \(d_i = s_i - \epsilon\) for pay_offset \(\delta\) and fixing_offset \(\epsilon\),

\[cf_i = N_i \cdot \tau(s_i,e_i) \cdot (c + f(d_i)).\]Note, the pay_offset \(\delta\) is not applied in case of the first cashflow, then \(s_1=t_0\).

- forward_curve¶

cashflow forward curve to derive float rates \(f\)

- property fixed_rate¶

Contingent Cashflow Objects (Options)¶

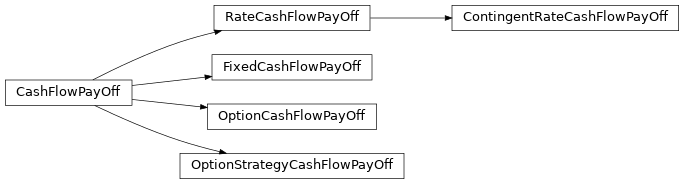

- class dcf.cashflows.contingent.ContingentCashFlowList(payment_date_list, payoff_list=None, origin=None, payoff_model=None)[source]¶

Bases:

CashFlowListlist of contingent cashflows

generic cashflow list of expected contingent cashflows i.e. non-deterministc cashflows like option payoffs.

- Parameters

payment_date_list – pay dates, assuming that pay dates agree with end dates of interest accrued period

payoff_list – list of payoffs

origin – start date of first interest accrued period

payoff_model – payoff model to derive the expected payoff

Since expectation depends on probabilities an approbiate payoff_model \(m\) to estimate expectations has to be supplied as argument to the list and applied - again as argument - to payoffs.

Therefor any item \(f_i\) in payoff_list has to be either a int pr float or callable with optional argument of a payoff_model and will return the expected cashflow amount as float value depending on the state given by the payoff_model.

\[f_i(m)=E\big[f_i\mid m\big]\]This non-sense use case demonstrates the pattern of evaluating payoffs. For more details who to use

dcf.cashflows.contingent.ContingentCashFlowListseedcf.cashflows.contingent.OptionCashflowList,dcf.cashflows.contingent.OptionStrategyCashflowListordcf.cashflows.contingent.ContingentRateCashFlowList.>>> from dcf import ContingentCashFlowList >>> p = lambda x: x*x >>> c = ContingentCashFlowList([1,2], [p, p], payoff_model=4) >>> c[c.domain] [16, 16] >>> c.payoff_model = 2 >>> c[c.domain] [4, 4]

- class dcf.cashflows.contingent.OptionCashflowList(payment_date_list, amount_list=1.0, strike_list=(), is_put_list=False, fixing_offset=None, pay_offset=None, origin=None, payoff_model=None)[source]¶

Bases:

ContingentCashFlowListlist of option cashflows

list of European option payoffs

- Parameters

payment_date_list – list of cashflow payment dates \(t_k\)

amount_list – list of option notional amounts \(N_k\)

strike_list – list of option strike prices \(K_k\)

is_put_list – list of boolean flags indicating if options are put options (optional: default is False)

fixing_offset – offset \(\delta\) between underlying fixing date and cashflow end date

pay_offset – offset \(\epsilon\) between cashflow end date and payment date

origin – origin of object, i.e. start date of the cashflow list as a product

payoff_model – payoff model to derive the expected payoff

- class dcf.cashflows.contingent.OptionStrategyCashflowList(payment_date_list, call_amount_list=1.0, call_strike_list=(), put_amount_list=1.0, put_strike_list=(), fixing_offset=None, pay_offset=None, origin=None, payoff_model=None)[source]¶

Bases:

ContingentCashFlowListlist of option strategy cashflows

series of identical option strategies

- Parameters

payment_date_list – list of cashflow payment dates \(t_k\)

call_amount_list – list of call option notional amounts \(N_{i}\)

call_strike_list – list of call option strikes \(K_{i}\)

put_amount_list – list of put option notional amounts \(N_{j}\)

put_strike_list – list of put option strikes \(L_{j}\)

fixing_offset – offset \(\delta\) between underlying fixing date and cashflow end date

pay_offset – offset \(\epsilon\) between cashflow end date and payment date

origin – origin of object, i.e. start date of the cashflow list as a product

payoff_model – payoff model to derive the expected payoff

dcf.cashflows.contingent.OptionStrategyCashflowListobject provides a list ofdcf.cashflows.payoffs.OptionStrategyCashFlowPayOff\(X_k\) objects with payment date \(t_k\).Adjustetd by offset \(X_k\) has expiry date \(T_k=t_k-\delta-\epsilon\) and for all \(k\) the same \(N_i\), \(K_i\), \(N_j\), \(L_j\) are used.

- class dcf.cashflows.contingent.ContingentRateCashFlowList(payment_date_list, amount_list=1.0, origin=None, day_count=None, fixing_offset=None, pay_offset=None, fixed_rate=0.0, cap_strike=None, floor_strike=None, payoff_model=None)[source]¶

Bases:

ContingentCashFlowListlist of cashflows by interest rate payments

list of contingend collared rate cashflows

- Parameters

payment_date_list – pay dates, assuming that pay dates agree with end dates of interest accrued period

amount_list – notional amounts

origin – start date of first interest accrued period

day_count – day count convention

fixed_rate – agreed fixed rate

forward_curve –

fixing_offset – time difference between interest rate fixing date and interest period payment date

pay_offset – time difference between interest period end date and interest payment date

floor_strike – lower interest rate boundary \(K\)

cap_strike – upper interest rate boundary \(L\)

payoff_model – option valuation model to derive the expected cashflow of option payoffs

Each object consists of a list of

dcf.cashflows.payoffs.ContingentRateCashFlowPayOff, i.e. of collared payoff functions\[X_i(f(T_i)) = [\max(K, \min(f(T_i), L)) + c]\ \tau(s,e)\ N\]with, according to a payment date \(p_i\), \(p_i-\epsilon=e_i\), \(e_i=s_{i+1}\) and \(s_i-\delta=T_i\).

- payoff_model¶

model to derive the expected cashflow of an option payoff

- property fixed_rate¶

Contingent Cashflow PayOffs¶

- class dcf.cashflows.payoffs.FixedCashFlowPayOff(amount=1.0)[source]¶

Bases:

CashFlowPayOfffixed cashflow payoff

- Parameters

amount – notional amount \(N\)

A fixed cashflow payoff \(X\) is given directly by the notional amount \(N\)

Invoking \(X()\) or \(X(m)\) with a

dcf.models.optionpricing.OptionPayOffModelobject \(m\) as argument returns the actual expected cashflow payoff amount of \(X\) which is again just the notional amount \(N\).>>> from dcf import FixedCashFlowPayOff >>> cf = FixedCashFlowPayOff(123.456) >>> cf() 123.456

- class dcf.cashflows.payoffs.RateCashFlowPayOff(start, end, amount=1.0, day_count=None, fixing_offset=None, fixed_rate=0.0)[source]¶

Bases:

CashFlowPayOffinterest rate cashflow payoff

- Parameters

start – cashflow accrued period start date \(s\)

end – cashflow accrued period end date \(e\)

amount – notional amount \(N\)

day_count – function to calculate accrued period year fraction \(\tau\)

fixing_offset – time difference between interest rate fixing date and interest period payment date \(\delta\)

fixed_rate – agreed fixed rate \(c\)

A contigent interest rate cashflow payoff \(X\) is given for a float rate \(f\) at \(T=s-\delta\)

\[X(f(T)) = (f(T) + c)\ \tau(s,e)\ N\]Invoking \(X(m)\) with a

dcf.models.optionpricing.OptionPayOffModelobject \(m\) as argument returns the actual expected cashflow payoff amount of \(X\).>>> from dcf import RateCashFlowPayOff, CashRateCurve

>>> cf = RateCashFlowPayOff(start=1.25, end=1.5, amount=1.0, fixed_rate=0.005) >>> f = CashRateCurve(domain=[0.0, 1.0, 2.0], data=[-0.005, 0.00, 0.001], forward_tenor=0.25)

>>> cf() 0.00125 >>> cf(f) 0.0013125

- start¶

interest accrued period start date

- end¶

interest accrued period end date

- day_count¶

interest accrued period day count method for rate period calculation \(\tau\)

- fixing_offset¶

time difference between interest rate fixing date and interest period payment date

- amount¶

cashflow notional amount

- fixed_rate¶

agreed fixed rate \(c\)

- class dcf.cashflows.payoffs.OptionCashFlowPayOff(expiry, amount=1.0, strike=None, is_put=False)[source]¶

Bases:

CashFlowPayOffEuropean option payoff function

- Parameters

expiry – option exipry date \(T\)

amount – option notional amount \(N\)

strike – strike price \(K\)

is_put – bool True for put options and False for call options (optional with default False)

An European call option \(C_K(S(T))\) is the right to buy an agreed amount \(N\) of an asset with future price \(S(T)\) at a future point in time \(T\) (the option exipry date) for a pre-agreed strike price \(K\).

The call option payoff provides the expected profit from such transaction, i.e.

\[C_K(S(T)) = N \cdot E[ \max(S(T)-K,0) ]\]Resp. a put option \(P_K(S(T))\) is the right to sell an asset at a pre-agreed strike price. Hence, the put option payoff provides the expected profit from such transaction, i.e.

\[P_K(S(T)) = N \cdot E[ \max(K-S(T),0) ]\]As the asset price \(S(t)\) is unknown at time \(t < T\), the estimation of \(C_K(S(T))\) resp. \(P_K(S(T))\) requires assumptions on the as randomness understood unkown behavior of \(S\) until \(T\).

This is provided by payoff_model implementing

dcf.models.optionpricing.OptionPayOffModeland is invoked by calling andcf.cashflows.payoffs.OptionCashFlowPayOffobject.First, setup a classical log-normal Black-Scholes model.

>>> from dcf.models import LogNormalOptionPayOffModel >>> from math import exp >>> f = lambda t: 100.0 * exp(t * 0.05) # spot price 100 and yield of 5% >>> v = lambda v: 0.1 # flat volatility of 10% >>> m = LogNormalOptionPayOffModel(valuation_date=0.0, forward_curve=f, volatility_curve=v)

Then, build a call option payoff.

>>> from dcf import OptionCashFlowPayOff >>> c = OptionCashFlowPayOff(expiry=0.25, strike=110.0) >>> # get expected option payoff >>> c(m) 0.10726740675017865

And a put option payoff.

>>> p = OptionCashFlowPayOff(expiry=0.25, strike=110.0, is_put=True) >>> # get expected option payoff >>> p(m) 8.849422252686733

- class dcf.cashflows.payoffs.OptionStrategyCashFlowPayOff(expiry, call_amount_list=1.0, call_strike_list=(), put_amount_list=1.0, put_strike_list=())[source]¶

Bases:

CashFlowPayOffoption strategy, i.e. series of call and put options with single expiry

- Parameters

expiry – option exiptry date \(T\)

call_amount_list – list of call option notional amounts \(N_i\)

call_strike_list – list of call option strikes \(K_i\)

put_amount_list – list of put option notional amounts \(N_j\)

put_strike_list – list of put option strikes \(L_j\)

The option strategy payoff \(X\) is the sum of call and put payoffs

\[X(S(T)) =\sum_{i=1}^m N_i \cdot C_{K_i}(S(T)) + \sum_{j=1}^n N_j \cdot P_{L_j}(S(T))\]see more on options strategies

First, setup a classical log-normal Black-Scholes model.

>>> from dcf.models import LogNormalOptionPayOffModel >>> from math import exp >>> # >>> f = lambda t: 100.0 * exp(t * 0.05) # spot price 100 and yield of 5% >>> v = lambda v: 0.1 # flat volatility of 10% >>> m = LogNormalOptionPayOffModel(valuation_date=0.0, forward_curve=f, volatility_curve=v)

Then, setup a butterlfy payoff and evaluate it.

>>> from dcf import OptionStrategyCashFlowPayOff >>> call_amount_list = 1., -2., 1. >>> call_strike_list = 100, 110, 120 >>> s = OptionStrategyCashFlowPayOff(expiry=1., call_amount_list=call_amount_list, call_strike_list=call_strike_list) >>> s(m) 3.06924777745399

- class dcf.cashflows.payoffs.ContingentRateCashFlowPayOff(start, end, amount=1.0, day_count=None, fixing_offset=None, fixed_rate=0.0, floor_strike=None, cap_strike=None)[source]¶

Bases:

RateCashFlowPayOffcontigent but collared interest rate cashflow payoff

- Parameters

start – cashflow accrued period start date \(s\)

end – cashflow accrued period end date \(e\)

amount – notional amount \(N\)

day_count – function to calculate accrued period year fraction \(\tau\)

fixing_offset – time difference between interest rate fixing date and interest period payment date \(\delta\)

fixed_rate – agreed fixed rate \(c\)

floor_strike – lower interest rate boundary \(K\)

cap_strike – upper interest rate boundary \(L\)

A collared interest rate cashflow payoff \(X\) is given for a float rate \(f\) at \(T=s-\delta\)

\[X(f(T)) = [\max(K, \min(f(T), L)) + c]\ \tau(s,e)\ N\]The foorlet (\(\max(K, \dots)\)) or resp. the caplet condition (\(\min(\dots, L)\)) will be ignored if \(K\) is or resp. \(L\) is None.

Invoking \(X(m)\) with a

dcf.models.optionpricing.OptionPayOffModelobject \(m\) as argument returns the actual expected cashflow payoff amount of \(X\).>>> from dcf import ContingentRateCashFlowPayOff, CashRateCurve >>> from dcf.models import NormalOptionPayOffModel, IntrinsicOptionPayOffModel

evaluate just the fixed rate cashflow

>>> cf = ContingentRateCashFlowPayOff(start=1.25, end=1.5, amount=1.0, fixed_rate=0.005, floor_strike=0.002) >>> cf() 0.00125

evaluate the fixed rate and float forward rate cashflow

>>> f = CashRateCurve(domain=[0.0, 1.0, 2.0], data=[-0.005, 0.00, 0.001], forward_tenor=0.25) >>> cf(f) 0.0013125

evaluate the fixed rate and float forward rate cashflow plus intrisic option payoff

>>> i = IntrinsicOptionPayOffModel(valuation_date=0.0, forward_curve=f) >>> cf(i) 0.00175

evaluate the fixed rate and float forward rate cashflow plus Bachelier model payoff

>>> m = NormalOptionPayOffModel(valuation_date=0.0, forward_curve=f, volatility_curve=(lambda *_: 0.005)) >>> cf(m) 0.0021158872175425702

- floor_strike¶

floor strike rate

- cap_strike¶

cap strike rate

Contingent Cashflow Models¶

intrisic option pricing formula |

|

Bachelier option pricing formula |

|

Black 76 option pricing formula |

|

displaced Black 76 option pricing formula |

- class dcf.models.optionpricing.OptionPricingFormula[source]¶

Bases:

objectabstract base class for option pricing formulas

A

dcf.models.optionpricing.OptionPricingFormula\(f\) serves as a kind of interface template to enhancedcf.models.optionpricing.OptionPayOffModelby a new model.To do so, \(f\) should at least implement a method

__call__(time, strike, forward, volatility)

to provide the expected payoff of an Europen call option. Alternativly, it could implement the same signatur for a private

_call_price(time, strike, forward, volatility)

method. These and all follwing method are only related to call options since put options will be derivend by the use of put-call parity.

Moreover, the volatility argument should be understood as a general input of model parameters which ar in case of classical option pricing formulas like

dcf.models.black76.LogNormalOptionPayOffModelthe volatility.To provide non-numerical derivatives implement

_call_delta(time, strike, forward, volatility)

for delta \(\Delta_f\), the first derivative along the underlying

_call_gamma(time, strike, forward, volatility)

for gamma \(\Gamma_f\), the second derivative along the underlying

_call_vega(time, strike, forward, volatility)

for vega \(\mathcal{V}_f\), the first derivative along the volatility parameters

_call_theta(time, strike, forward, volatility)

for theta \(\Theta_f\), the first derivative along the time parameter time

- classmethod from_function(func, name=None)[source]¶

create new type (class) of an OptionPricingFormula

- Parameters

func – function serving as __call__ method as in

dcf.models.optionpricing.OptionPricingFormula- Returns

subclass of

dcf.models.optionpricing.OptionPricingFormula

- class dcf.models.optionpricing.OptionPayOffModel(valuation_date=None, forward_curve=None, volatility_curve=None, day_count=None, bump_greeks=None)[source]¶

Bases:

OptionPricingFormulabase option payoff model to derive expected payoff cashflows

option payoff model

- Parameters

valuation_date – date of option valuation \(t\)

forward_curve – curve for deriving forward values

volatility_curve – parameter curve of option pricing formulas

day_count – day count function to calculate year fraction between dates, e.g. option expiry and valueation date

bump_greeks – bool - if True Greeks, i.e. sensitivities/derivatives, are derived numericaly. If False analytics functions are used, if given. See also

dcf.models.optionpricing.OptionPricingFormula. (optional; default is False)

- DELTA_SHIFT = 0.0001¶

finite difference to calculate numerical delta sensitivities

- DELTA_SCALE = 0.0001¶

factor to express numerical delta sensitivities usually in a value of a basis point (bpv)

Let \(\delta\) be the DELTA_SHIFT and \(\epsilon\) be the DELTA_SCALE and \(f\) a forward \(F\) sensitive function such that

\[f' = \frac{df}{dF} \approx \Delta_f(F) = \frac{f(F+\delta) - f(x)}{\delta/\epsilon}.\]

- VEGA_SHIFT = 0.01¶

finite difference to calculate numerical vega sensitivities

- VEGA_SCALE = 0.01¶

factor to express numerical vega sensitivities

Let \(\delta\) be the VEGA_SHIFT and \(\epsilon\) be the VEGA_SCALE and \(f\) a volatility \(\nu\) sensitive function such that

\[f'_\nu = \frac{df}{d\nu} \approx \mathcal{V}_f(\nu) = \frac{f(\nu+\delta) - f(\nu)}{\delta/\epsilon}.\]

- THETA_SHIFT = 0.0027378507871321013¶

finite difference to calculate numerical theta sensitivities usually one day (1/365.25)

- THETA_SCALE = 0.0027378507871321013¶

factor to express numerical theta sensitivities usually one day (1/365.25)

Let \(\delta\) be the THETA_SHIFT and \(\epsilon\) be the THETA_SCALE and \(f\) a time \(\tau(t,T)\) sensitive function with valuation date \(t\) and option maturity date \(T\) such that

\[\dot{f} = \frac{df}{dt} \approx \Theta_f(t) = \frac{f(\tau(t,T)+\delta) - f(\tau(t,T))}{\delta/\epsilon}.\]

- valuation_date¶

date of option valuation \(t\)

- forward_curve¶

curve for deriving forward values \(F(t)\)

- volatility_curve¶

parameter curve of option pricing formulas \(\nu(t)\)

- day_count¶

day count function to calculate year fraction between dates \(\tau\)

- details(date, strike=None)[source]¶

model parameter details

- Parameters

date – option expiry date (also fixing date)

strike – option strike value (optional; default None, i.e. at-the-money)

- Returns

dict()

- get_call_value(date, strike=None)[source]¶

value of a call option

- Parameters

date – expiry date \(T\)

strike – option strike price \(K\) of underlying \(F\)

- Returns

\(C_K(F(T))=E[\max(F(T)-K, 0)]\)

- get_put_value(date, strike=None)[source]¶

value of a put option

- Parameters

date – expiry date \(T\)

strike – option strike price \(K\) of underlying \(F\)

- Returns

\(P_K(F(T))=E[\max(K-F(T), 0)]\)

Note \(P_K(F(T))\) is derived by put-call parity:

\[P_K(F(T)) = K - F(T) + C_K(F(T))\]

- get_call_delta(date, strike=None)[source]¶

delta sensitivity of a call option

- Parameters

date – expiry date \(T\)

strike – option strike price \(K\) of underlying \(F\)

- Returns

\(\Delta_{C_K(F)} = \frac{d}{d F} C_K(F)\)

\(\Delta_{C_K(F)}\) is the first derivative of \(C_K(F)\) in unterlying direction \(F\).

- get_put_delta(date, strike=None)[source]¶

delta sensitivity of a put option

- Parameters

date – expiry date \(T\)

strike – option strike price \(K\) of underlying \(F\)

- Returns

\(\Delta_{P_K(F)} = \frac{d}{d F} P_K(F)\)

\(\Delta_{P_K(F)}\) is the first derivative of \(P_K(F)\) in unterlying direction \(F\) and is derived by put-call parity, too:

\[\Gamma_{P_K(F)} = \Delta_{C_K(F)} - 1\]Note, here \(1\) is actualy scaled by

dcf.models.optionpricing.OptionPayOffModel.DELTA_SCALE.

- get_call_gamma(date, strike=None)[source]¶

gamma sensitivity of a call option

- Parameters

date – expiry date \(T\)

strike – option strike price \(K\) of underlying \(F\)

- Returns

\(\Gamma_{C_K(F)} = \frac{d^2}{d F^2} C_K(F)\)

\(\Gamma_{C_K(F)}\) is the second derivative of \(C_K(F)\) in unterlying direction \(F\).

- get_put_gamma(date, strike=None)[source]¶

gamma sensitivity of a put option

- Parameters

date – expiry date \(T\)

strike – option strike price \(K\) of underlying \(F\)

- Returns

\(\Gamma_{P_K(F)} = \frac{d^2}{d F^2} P_K(F)\)

\(\Gamma_{P_K(F)}\) is the second derivative of \(P_K(F)\) in unterlying direction \(F\) and is derived by put-call parity, too:

\[\Gamma_{P_K(F)} = \Gamma_{C_K(F)}\]

- get_call_vega(date, strike=None)[source]¶

vega sensitivity of a call option

- Parameters

date – expiry date \(T\)

strike – option strike price \(K\) of underlying \(F\)

- Returns

\(\mathcal{V}_{C_K(F)} = \frac{d}{d v} C_K(F)\)

\(\mathcal{V}_{C_K(F)}\) is the first derivative of \(C_K(F)\) in volatility parameter direction \(v\).

- get_put_vega(date, strike=None)[source]¶

vega sensitivity of a put option

- Parameters

date – expiry date \(T\)

strike – option strike price \(K\) of underlying \(F\)

- Returns

\(\mathcal{V}_{P_K(F)} = \frac{d}{d v} P_K(F)\)

\(\mathcal{V}_{P_K(F)}\) is the first derivative of \(P_K(F)\) in volatility parameter direction \(v\) and is derived by put-call parity, too:

\[\mathcal{V}_{P_K(F)} = V{C_K(F)}\]

- get_call_theta(date, strike=None)[source]¶

time sensitivity of a call option

- Parameters

date – expiry date \(T\)

strike – option strike price \(K\) of underlying \(F\)

- Returns

\(\Theta_{C_K(F)} = \frac{d}{d t} C_K(F)\)

\(\Theta_{C_K(F)}\) is the first derivative of \(C_K(F)\) in time parameter direction, i.e. valuation date \(t\).

- get_put_theta(date, strike=None)[source]¶

time sensitivity of a put option

- Parameters

date – expiry date \(T\)

strike – option strike price \(K\) of underlying \(F\)

- Returns

\(\Theta_{P_K(F)} = \frac{d}{d t} P_K(F)\)

\(\Theta_{P_K(F)}\) is the first derivative of \(P_K(F)\) in time parameter direction, i.e. valuation date \(t\).

- class dcf.models.optionpricing.BinaryOptionPayOffModel(pricing_formula, strike_shift=None, valuation_date=None, forward_curve=None, volatility_curve=None, day_count=None)[source]¶

Bases:

OptionPayOffModelbiniary option payoff model (derived by finite differences)

- Parameters

pricing_formula – option pricing formula; eithter

dcf.models.optionpricing.OptionPricingFormulaordcf.models.optionpricing.OptionPayOffModelstrike_shift – finite difference to calculate binary option payoff as a call spread (optional: default taken from

dcf.models.optionpricing.BinaryOptionPayOffModel.STRIKE_SHIFT)valuation_date – date of option valuation \(t\) (optional: default taken from pricing_formula)

forward_curve – curve for deriving forward values (optional: default taken from pricing_formula)

volatility_curve – parameter curve of option pricing formulas (optional: default taken from pricing_formula)

day_count – day count function to calculate year fraction between dates, e.g. option expiry and valueation date (optional: default taken from pricing_formula)

Let \(\delta\) be the STRIKE_SHIFT and \(f\) a option payoff with strike \(K\) such that the binary payoff is given as

\[f' = \frac{df}{dK} \approx \frac{f(K+\delta/2) - f(K-\delta/2)}{\delta}.\]- STRIKE_SHIFT = 0.0001¶

finite difference to calculate binary option payoff as a call spread

- class dcf.models.intrinsic.IntrinsicOptionPayOffModel(valuation_date=None, forward_curve=None, volatility_curve=None, day_count=None, bump_greeks=None)[source]¶

Bases:

OptionPayOffModelintrisic option pricing formula

implemented for call options (see more on intrisic option values)

Let \(F\) be the current forward value. Let \(K\) be the option strike value, \(\tau\) the time to matruity, i.e. the option expitry date.

Then

call price:

\[\max(F-K, 0)\]call delta:

\[0 \text{ if } F < K \text{ else } 1\]call gamma:

\[0\]call vega:

\[0\]

option payoff model

- Parameters

valuation_date – date of option valuation \(t\)

forward_curve – curve for deriving forward values

volatility_curve – parameter curve of option pricing formulas

day_count – day count function to calculate year fraction between dates, e.g. option expiry and valueation date

bump_greeks – bool - if True Greeks, i.e. sensitivities/derivatives, are derived numericaly. If False analytics functions are used, if given. See also

dcf.models.optionpricing.OptionPricingFormula. (optional; default is False)

- class dcf.models.intrinsic.BinaryIntrinsicOptionPayOffModel(valuation_date=None, forward_curve=None, volatility_curve=None, day_count=None, bump_greeks=None)[source]¶

Bases:

OptionPayOffModelintrisic option pricing formula for binary call options (see also

dcf.models.intrinsic.IntrinsicOptionPayOffModel)Let \(F\) be the current forward value. Let \(K\) be the option strike value, \(\tau\) the time to matruity, i.e. the option expitry date.

Then

call price:

\[0 \text{ if } F < K \text{ else } 1\]call delta:

\[0\]call gamma:

\[0\]call vega:

\[0\]

option payoff model

- Parameters

valuation_date – date of option valuation \(t\)

forward_curve – curve for deriving forward values

volatility_curve – parameter curve of option pricing formulas

day_count – day count function to calculate year fraction between dates, e.g. option expiry and valueation date

bump_greeks – bool - if True Greeks, i.e. sensitivities/derivatives, are derived numericaly. If False analytics functions are used, if given. See also

dcf.models.optionpricing.OptionPricingFormula. (optional; default is False)

- class dcf.models.bachelier.NormalOptionPayOffModel(valuation_date=None, forward_curve=None, volatility_curve=None, day_count=None, bump_greeks=None)[source]¶

Bases:

OptionPayOffModelBachelier option pricing formula

implemented for call options (see more on Bacheliers model)

Let \(f\) be a normaly distributed random variable with expectation \(F=E[f]\), the current forward value and \(\Phi\) the standard normal cummulative distribution function s.th. \(\phi=\Phi'\) is its density function.

Let \(K\) be the option strike value, \(\tau\) the time to matruity, i.e. the option expitry date, and \(\sigma\) the volatility parameter, i.e. the standard deviation of \(f\). Moreover, let

\[d = \frac{F-K}{\sigma \cdot \sqrt{\tau}}\]Then

call price:

\[(F-K) \cdot \Phi(d) + \sigma \cdot \sqrt{\tau} \cdot \phi(d)\]call delta:

\[\Phi(d)\]call gamma:

\[\frac{\phi(d)}{\sigma \cdot \sqrt{\tau}}\]call vega:

\[\sqrt{\tau} \cdot \phi(d)\]

option payoff model

- Parameters

valuation_date – date of option valuation \(t\)

forward_curve – curve for deriving forward values

volatility_curve – parameter curve of option pricing formulas

day_count – day count function to calculate year fraction between dates, e.g. option expiry and valueation date

bump_greeks – bool - if True Greeks, i.e. sensitivities/derivatives, are derived numericaly. If False analytics functions are used, if given. See also

dcf.models.optionpricing.OptionPricingFormula. (optional; default is False)

- class dcf.models.bachelier.BinaryNormalOptionPayOffModel(valuation_date=None, forward_curve=None, volatility_curve=None, day_count=None, bump_greeks=None)[source]¶

Bases:

OptionPayOffModelBachelier option pricing formula for binary calls (see also

dcf.models.bachelier.NormalOptionPayOffModel)Let \(f\) be a normaly distributed random variable with expectation \(F=E[f]\), the current forward value and \(\Phi\) the standard normal cummulative distribution function s.th. \(\phi=\Phi'\) is its density function.

Let \(K\) be the option strike value, \(\tau\) the time to matruity, i.e. the option expitry date, and \(\sigma\) the volatility parameter, i.e. the stanard deviation of \(f\). Moreover, let

\[d = \frac{F-K}{\sigma \cdot \sqrt{\tau}}\]Then

call price:

\[\Phi(d)\]call delta:

\[\frac{\phi(d)}{\sigma \cdot \sqrt{\tau}}\]call gamma:

\[d \cdot \frac{\phi(d)}{\sigma^2 \cdot \tau}\]call vega:

\[\sqrt{\tau} \cdot \phi(d)\]

option payoff model

- Parameters

valuation_date – date of option valuation \(t\)

forward_curve – curve for deriving forward values

volatility_curve – parameter curve of option pricing formulas

day_count – day count function to calculate year fraction between dates, e.g. option expiry and valueation date

bump_greeks – bool - if True Greeks, i.e. sensitivities/derivatives, are derived numericaly. If False analytics functions are used, if given. See also

dcf.models.optionpricing.OptionPricingFormula. (optional; default is False)

- class dcf.models.black76.LogNormalOptionPayOffModel(valuation_date=None, forward_curve=None, volatility_curve=None, day_count=None, bump_greeks=None)[source]¶

Bases:

OptionPayOffModelBlack 76 option pricing formula

implemented for call options (see more on Black 76 model which is closly related to the Black-Scholes model)

Let \(f\) be a log-normaly distributed random variable with expectation \(F=E[f]\), the current forward value and \(\Phi\) the standard normal cummulative distribution function s.th. \(\phi=\Phi'\) is its density function.

Let \(K\) be the option strike value, \(\tau\) the time to maturity, i.e. the option expiry date, and \(\sigma\) the volatility parameter, i.e. the standard deviation of \(\log(f)\). Moreover, let

\[d =\frac{\log(F/K) + (\sigma^2 \cdot \tau)/2}{\sigma \cdot \sqrt{\tau}}\]Then

call price:

\[F \cdot \Phi(d) - K \cdot \Phi(d-\sigma \cdot \sqrt{\tau})\]call delta:

\[\Phi(d)\]call gamma:

\[\frac{\phi(d)}{F \cdot \sigma \cdot \sqrt{\tau}}\]call vega:

\[F \cdot \sqrt{\tau} \cdot \phi(d)\]

option payoff model

- Parameters

valuation_date – date of option valuation \(t\)

forward_curve – curve for deriving forward values

volatility_curve – parameter curve of option pricing formulas

day_count – day count function to calculate year fraction between dates, e.g. option expiry and valueation date

bump_greeks – bool - if True Greeks, i.e. sensitivities/derivatives, are derived numericaly. If False analytics functions are used, if given. See also

dcf.models.optionpricing.OptionPricingFormula. (optional; default is False)

- class dcf.models.black76.BinaryLogNormalOptionPayOffModel(valuation_date=None, forward_curve=None, volatility_curve=None, day_count=None, bump_greeks=None)[source]¶

Bases:

OptionPayOffModelBlack 76 option pricing formula for binary calls (see also

dcf.models.black76.LogNormalOptionPayOffModel)Let \(f\) be a log-normaly distributed random variable with expectation \(F=E[f]\), the current forward value and \(\Phi\) the standard normal cummulative distribution function s.th. \(\phi=\Phi'\) is its density function.

Let \(K\) be the option strike value, \(\tau\) the time to maturity, i.e. the option expiry date, and \(\sigma\) the volatility parameter, i.e. the standard deviation of \(\log(f)\). Moreover, let

\[d =\frac{\log(F/K) + (\sigma^2 \cdot \tau)/2}{\sigma \cdot \sqrt{\tau}}\]Then

call price:

\[\Phi(d)\]call delta:

\[\frac{\phi(d-\sigma \cdot \sqrt{\tau})}{\sigma \cdot \sqrt{\tau}}\]call gamma:

\[d \cdot \frac{\phi(d)}{\sigma^2 \cdot \tau}\]call vega:

\[(d/\sigma - \sqrt{\tau}) \cdot \phi(d)\]

option payoff model

- Parameters

valuation_date – date of option valuation \(t\)

forward_curve – curve for deriving forward values

volatility_curve – parameter curve of option pricing formulas

day_count – day count function to calculate year fraction between dates, e.g. option expiry and valueation date

bump_greeks – bool - if True Greeks, i.e. sensitivities/derivatives, are derived numericaly. If False analytics functions are used, if given. See also

dcf.models.optionpricing.OptionPricingFormula. (optional; default is False)

- class dcf.models.displaced.DisplacedLogNormalOptionPayOffModel(valuation_date=None, forward_curve=None, volatility_curve=None, day_count=None, bump_greeks=None, displacement=0.0)[source]¶

Bases:

LogNormalOptionPayOffModeldisplaced Black 76 option pricing formula

implemented for call options (see also

dcf.models.black76.LogNormalOptionPayOffModel)The displaced Black 76 is adopted to handel moderate negative underlying forward prices or rates \(f\), e.g. as see for interest rates in the past. To do so, rather than \(f\) a shifted or displaced version \(f + \alpha\) is assumed to be log-normaly distributed for some negative value of \(\alpha\).

Hence, let \(f + \alpha\) be a log-normaly distributed random variable with expectation \(F + \alpha=E[f + \alpha]\), where \(F=E[f]\) is the current forward value and \(\Phi\) the standard normal cummulative distribution function s.th. \(\phi=\Phi'\) is its density function.

Let \(K\) be the option strike value, \(\tau\) the time to maturity, i.e. the option expiry date, and \(\sigma\) the volatility parameter, i.e. the standard deviation of \(\log(f + \alpha)\). Moreover, let

\[d =\frac{\log((F+\alpha)/(K+\alpha)) + (\sigma^2 \cdot \tau)/2}{\sigma \cdot \sqrt{\tau}}\]Then

call price:

\[(F+\alpha) \cdot \Phi(d) - (K+\alpha) \cdot \Phi(d-\sigma \cdot \sqrt{\tau})\]call delta:

\[\Phi(d)\]call gamma:

\[\frac{\phi(d)}{(F+\alpha) \cdot \sigma \cdot \sqrt{\tau}}\]call vega:

\[(F+\alpha) \cdot \sqrt{\tau} \cdot \phi(d)\]

option payoff model

- Parameters

valuation_date – date of option valuation \(t\)

forward_curve – curve for deriving forward values

volatility_curve – parameter curve of option pricing formulas

day_count – day count function to calculate year fraction between dates, e.g. option expiry and valueation date

bump_greeks – bool - if True Greeks, i.e. sensitivities/derivatives, are derived numericaly. If False analytics functions are used, if given. See also

dcf.models.optionpricing.OptionPricingFormula. (optional; default is False)

- class dcf.models.displaced.BinaryDisplacedLogNormalOptionPayOffModel(valuation_date=None, forward_curve=None, volatility_curve=None, day_count=None, bump_greeks=None, displacement=0.0)[source]¶

Bases:

BinaryLogNormalOptionPayOffModeldisplaced Black 76 option pricing formula for binary calls (see also

dcf.models.displaced.DisplacedLogNormalOptionPayOffModel)Uses

dcf.models.black76.BinaryLogNormalOptionPayOffModelformulas withdisplaced forward \(F+\alpha\)

and

displaced strike \(K+\alpha\)

option payoff model

- Parameters

valuation_date – date of option valuation \(t\)

forward_curve – curve for deriving forward values

volatility_curve – parameter curve of option pricing formulas

day_count – day count function to calculate year fraction between dates, e.g. option expiry and valueation date

bump_greeks – bool - if True Greeks, i.e. sensitivities/derivatives, are derived numericaly. If False analytics functions are used, if given. See also

dcf.models.optionpricing.OptionPricingFormula. (optional; default is False)

Valuation Routines¶

Present Value¶

- dcf.pricer.get_present_value(cashflow_list, discount_curve, valuation_date=None)[source]¶

calculates the present value by discounting cashflows

- Parameters

cashflow_list – list of cashflows

discount_curve – discount factors are obtained from this curve

valuation_date – date to discount to (optional; default: discount_curve.origin)

- Returns

float - as the sum of all discounted future cashflows

Let \(cf_1 \dots cf_n\) be the list of cashflows with payment dates \(t_1, \dots, t_n\).

Moreover, let \(t\) be the valuation date and \(T=\{t_i \mid t \leq t_i \}\).

Then the present value is given as

\[v(t) = \sum_{t_i \in T} df(t, t_i) \cdot cf_i\]with \(df(t, t_i)\), the discount factor discounting form \(t_i\) to \(t\).

Note, get_present_value includes cashflows at valuation date. Therefor it represents a start-of-day valuation than a end-of-day valuation.

>>> from dcf import CashFlowList, ZeroRateCurve, get_present_value >>> cfs = CashFlowList([0, 1, 2, 3],[100, 100, 100, 100]) >>> curve = ZeroRateCurve([0], [0.05]) >>> valuation_date = 0 >>> sod = get_present_value(cfs, curve, valuation_date) >>> sod 371.67748189617316 >>> eod = sod - cfs[valuation_date] >>> eod 271.67748189617316

Yield To Maturity¶

- dcf.pricer.get_yield_to_maturity(cashflow_list, valuation_date=None, present_value=0.0, precision=1e-07, bounds=(- 0.1, 0.2), **kwargs)[source]¶

yield-to-maturity or effective interest rate

- Parameters

cashflow_list – list of cashflows

valuation_date – date to discount to (optional; default: cashflow_list.origin)

present_value – price to meet by discounting (optional; default: 0.0)

precision – max distance of present value to par (optional: default is 1e-7)

bounds – tuple of lower and upper bound of yield to maturity (optional: default is -0.1 and .2)

kwargs – additional keyword used for constructing

dcf.curves.interestratecurve.ZeroRateCurve

- Returns

float - as flat interest rate to discount all future cashflows in order to meet given present_value

Let \(cf_1 \dots cf_n\) be the list of cashflows with payment dates \(t_1, \dots, t_n\).

Moreover, let \(t\) be the valuation date and \(T=\{t_i \mid t \leq t_i \}\).

Then the yield-to-maturity is the interest rate \(y\) such that the present_value \(\hat{v}\) is given as

\[\hat{v} = \sum_{t_i \in T} df(t, t_i) \cdot cf_i\]with \(df(t, t_i) = \exp(-y \cdot (t_i-t))\), the discount factor discounting form \(t_i\) to \(t\).

Example

yield-to-matrurity of 5y fixed coupon bond

>>> from dcf import RateCashFlowList, FixedCashFlowList, CashFlowLegList >>> from dcf import get_present_value, get_yield_to_maturity >>> from dcf import ZeroRateCurve

>>> n, df = 1e6, ZeroRateCurve([0], [0.015]) >>> coupon_leg = RateCashFlowList([1,2,3,4,5], amount_list=n, origin=0, fixed_rate=0.001) >>> redemption_leg = FixedCashFlowList([5], amount_list=n) >>> bond = CashFlowLegList((redemption_leg, coupon_leg))

bond with cashflow tables

>>> print(tabulate(coupon_leg.table, headers='firstrow')) cashflow pay date notional start date end date year fraction fixed rate ---------- ---------- ---------- ------------ ---------- --------------- ------------ 1000 1 1e+06 0 1 1 0.001 1000 2 1e+06 1 2 1 0.001 1000 3 1e+06 2 3 1 0.001 1000 4 1e+06 3 4 1 0.001 1000 5 1e+06 4 5 1 0.001

>>> print(tabulate(redemption_leg.table, headers='firstrow')) cashflow pay date ---------- ---------- 1e+06 5

get yield-to-maturity at par (gives coupon rate)

>>> ytm = get_yield_to_maturity(bond, valuation_date=0, present_value=n) >>> round(ytm, 6) 0.001

get current yield-to-maturity as given by 1.5% risk free rate (gives risk free rate)

>>> pv = get_present_value(bond, df, valuation_date=0) >>> pv 932524.5493034503 >>> >>> ytm = get_yield_to_maturity(bond, valuation_date=0, present_value=pv) >>> round(ytm, 6) 0.015

Fair Rate¶

- dcf.pricer.get_fair_rate(cashflow_list, discount_curve, valuation_date=None, present_value=0.0, precision=1e-07, bounds=(- 0.1, 0.2))[source]¶

coupon rate to meet given value

- Parameters

cashflow_list – list of cashflows

discount_curve – discount factors are obtained from this curve

valuation_date – date to discount to

present_value – price to meet by discounting

precision – max distance of present value to par (optional: default is 1e-7)

bounds – tuple of lower and upper bound of fair rate (optional: default is -0.1 and .2)

- Returns

float - the fair coupon rate as fixed_rate of a

dcf.cashflows.cashflow.RateCashFlowList

Let \(cf_i(c) = N_i \cdot \tau(s_i,e_i) \cdot (c + f(d_i))\) be the \(i\)-th cashflow in the cashflow_list.

Here, the fair rate is the fixed_rate \(c=\hat{c}\) such that the present_value \(\hat{v}\) is given as

\[\hat{v} = \sum_{t_i \in T} df(t, t_i) \cdot cf_i(\hat{c})\]with \(df(t, t_i)\), the discount factor discounting form \(t_i\) to \(t\).

Note, get_fair_rate requires the cashflow_list to have an attribute fixed_rate which is perturbed to find the solution for \(\hat{c}\).

Example

>>> from dcf import RateCashFlowList, FixedCashFlowList, CashFlowLegList >>> from dcf import get_present_value, get_fair_rate >>> from dcf import ZeroRateCurve

setup 5y coupon bond